Technology Hype Cycles

Hype occurs in cycles. It starts with the introduction of a concept and thinking about the possibilities.The more that is possible, the higher expectations rise.

Then it’s time to take the medicine and figure out the exact reality of the situation. Often it is less than expected, and much work is still to be done to bring an idea to fruition.

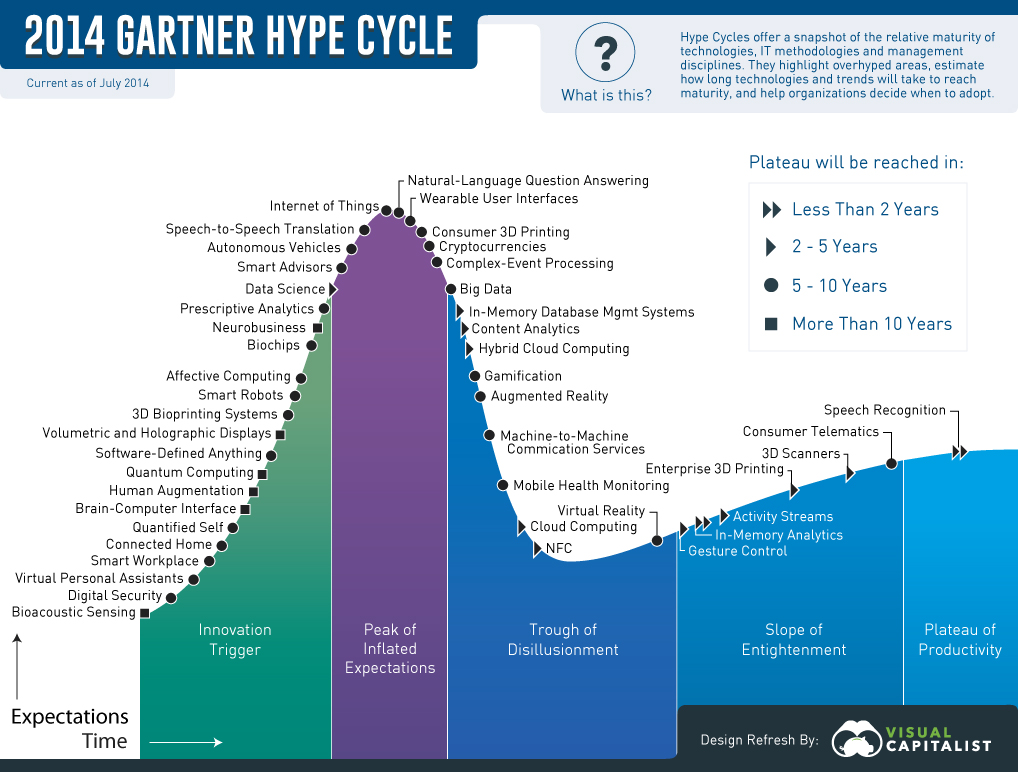

Every year, Garner publishes a great resource called the Technology Hype Cycle. We did a quick re-design above. It takes all the broad concepts in technology, and plots them along a typical plot that shows expectations over time. For any retail investor looking at technology opportunities, taking this into consideration is imperative. Before proper revenue and profit generation, many deals operate on these sets of expectations.

At Visual Capitalist, we try to cover these upcoming opportunities to show investors their potential. Over the past couple of years, we’ve covered things such as Bitcoin, 3D Printing, Wearable Tech, The Internet of Things, and Graphene to keep you on the forefront of innovation.

Like the resource investment lifecycle, this hype cycle creates broad opportunities for the savvy investor. Two obvious ways to take advantage:

1) Identify a broad category of technology as it comes as an innovation trigger, and find early stage investments to ride the increasing expectations.

2) Identify companies that are on the way to successfully realizing the potential of technologies that are new but where the shine has worn off. For example: enterprise 3d printing, virtual reality, and cloud computing.

Virtual reality, as an example, was cool around 15 years ago. Now people have forgotten about it. However, there are companies that are on the verge of revolutionizing the field and it will be in the news again soon.